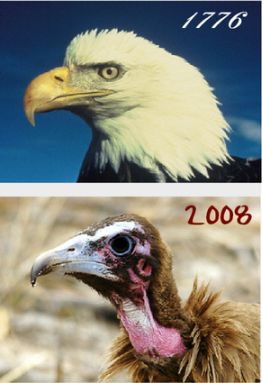

I picked this piece up somewhere on my web travels. The piece was unattributed, but the writer clearly knows his stuff and every word of it is true. Here's a very easy-to-understand and readable summary of how we got into the mess we're in today. It's such a great item that World Peace simply couldn't ignore it!

Items begins:

1) Once, gold and silver were considered the only ”real” money, but it was heavy and risky to carry around…

2) So people paid goldsmiths to store their gold and silver, and got paper receipts for it…

3) After a while, people gave and exchanged the receipts to settle debts, and simply left the gold with the goldsmiths. So the 'smiths got clever and came up with a scam…

4) They printed out receipts for more gold than they actually had, and ”loaned” those receipts out and charged interest on them. They had to keep the truth about how much gold they REALLY had a secret and hope that not too many people would ask. This let them make a lot of money charging interest, because they could charge interest on MONEY THEY DIDN’T HAVE AND WHICH DIDN'T EVEN EXIST.

An analogy can be made using property and titles. Here’s the scam illustrated another way:

Step 1: Acquire a vacation home.

Step 2: Sell the title to the home to one person.

Step 3: Sell the title to the home to a DIFFERENT person,

Step 4: Hope they both don’t show up on the same weekend!

Fractional reserve banking lets a bank say to a depositor that all his money is safe and sound at the bank, while at the same time they get to loan most of it out to someone else to charge interest on it. So there are two people with a legitimate claim to the same pile of money. So whose is it, really? And WHERE is it? In practice, around 88% of money deposited is never withdrawn at short notice so only 12% need be retained in cash by the bank. The bulk can be on-lent.

It gets stranger: when a borrower gets their money, one way or another, it will end up deposited into a bank as well. This money then becomes backing for another loan, and that loan gets deposited, becoming backing for yet another. If you do the math, you will see that far more money is on deposit in all the banks than existed in the first place! Where does all this money come from? The answer: It is simply CREATED. Since money is not gold any more, but only paper, banks can ask the Federal Reserve system to just print more!

The story of the vacation home is a good analogy of how banking works today, except for one important thing: there is no home. Without gold, silver, or some other commodity backing it, we have all been trading titles to property that doesn’t exist! Paper backs paper, and all they represent are promises to pay. This is the reality of money, and is quite different from how most of us expect it to be.

What’s the result?

1) Loaning money while claiming it is still on deposit increases the money supply, essentially creating more money (otherwise deposits would vanish). In essence, for the bank to have your cake and loan it too, it must create more cake. This increase in money supply is the cause of inflation.

2) Almost every dollar that exists is owed to a bank somewhere, because at some time in history, it was created when it was loaned out.

3) The amount of money owed to banks is more than all the money in existence! So we cannot possibly get out of debt under this system. The bulk of this debt is in the form of interest, which is an arbitrary amount of money banks demand in return, but never gave in the first place.

4) There is no money, in the real sense. Just checks, data stored on computers, and promises. It is all created by typing on a keyboard, and signing signatures. The only tangible assets in regard to money anymore is the collateral we pledge when we ask for a loan. The money they loan you comes from nowhere, but the assets you lose in foreclosure are REAL!

5) Because the US government borrows from the Federal Reserve, bankers have the power to influence our society and government by controlling finance. They decide to create (or not create) money depending on who’s asking, and for what. They choose what projects get funded, and let other needs wither on the vine by starving them of working capital. This subtle yet immense power is more than enough to undermine democracy, and guide the course of a nation’s history.

So what’s the solution?

Simple. The public must demand that money must not be created by loaning it into existence. It must be something that is openly and publicly controllable, issuable, accountable, completely transparent, and interest-free. Otherwise, a class of parasites will rise to power in society by cleverly disguising the fact that the money they are creating, spending, and controlling us with is MONEY THAT ISN’T EVEN REAL.

Item ends.

Well I think we can all guess who this class of parasites to whom the writer refers consists of, can't we, readers? The problem is, however, that they arose a long, long time ago and what are we going to do about it?

Friday, April 18, 2008

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment